Does Your Financial Plan Answer Your ‘What Ifs’?

Have you ever thought about your future and wondered ‘what if?’ Now imagine if you could explore those different ‘what ifs’ with your advisor, and instantly see the impact on your financial well-being.

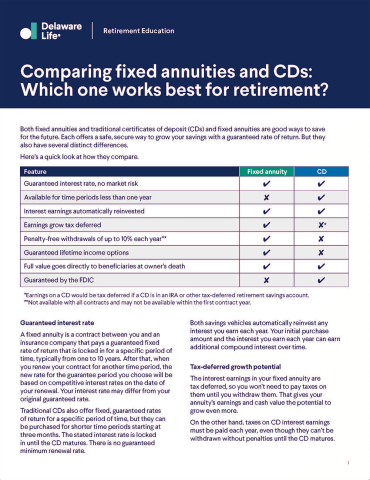

Comparing fixed annuities and CDs: Which one works best for retirement?

Both fixed annuities and traditional certificates of deposit (CDs) and fixed annuities are good ways to save for the future. Each offers a safe, secure way to grow your savings with a guaranteed rate of return. But they also have several distinct differences.

Fixed Annuities are long term insurance contacts and there is a surrender charge imposed generally during the first 5 to 7 years that you own the annuity contract. Withdrawals prior to age 59-1/2 may result in a 10% IRS tax penalty, in addition to any ordinary income tax. Any guarantees of the annuity are backed by the financial strength of the underlying insurance company.